We decided to re-send Saturday’s missive today in case you missed it last weekend. If you didn’t, you’ll know we talk about how surplus productivity has shifted the U.S. economy’s drivers of growth towards more investment and inventories, something the IFM seems to agree with according to today’s Wall Street Journal. The difference, of course, is you read it here first, days ahead of everyone else. But that’s what you get when you follow economic content that leads. - Paul Allen Winghart 10/22/2024

October 19th 2024 - Volume 10 (2024), Missive 232 (Saturday)

GDP’s expected unexpected growth explained

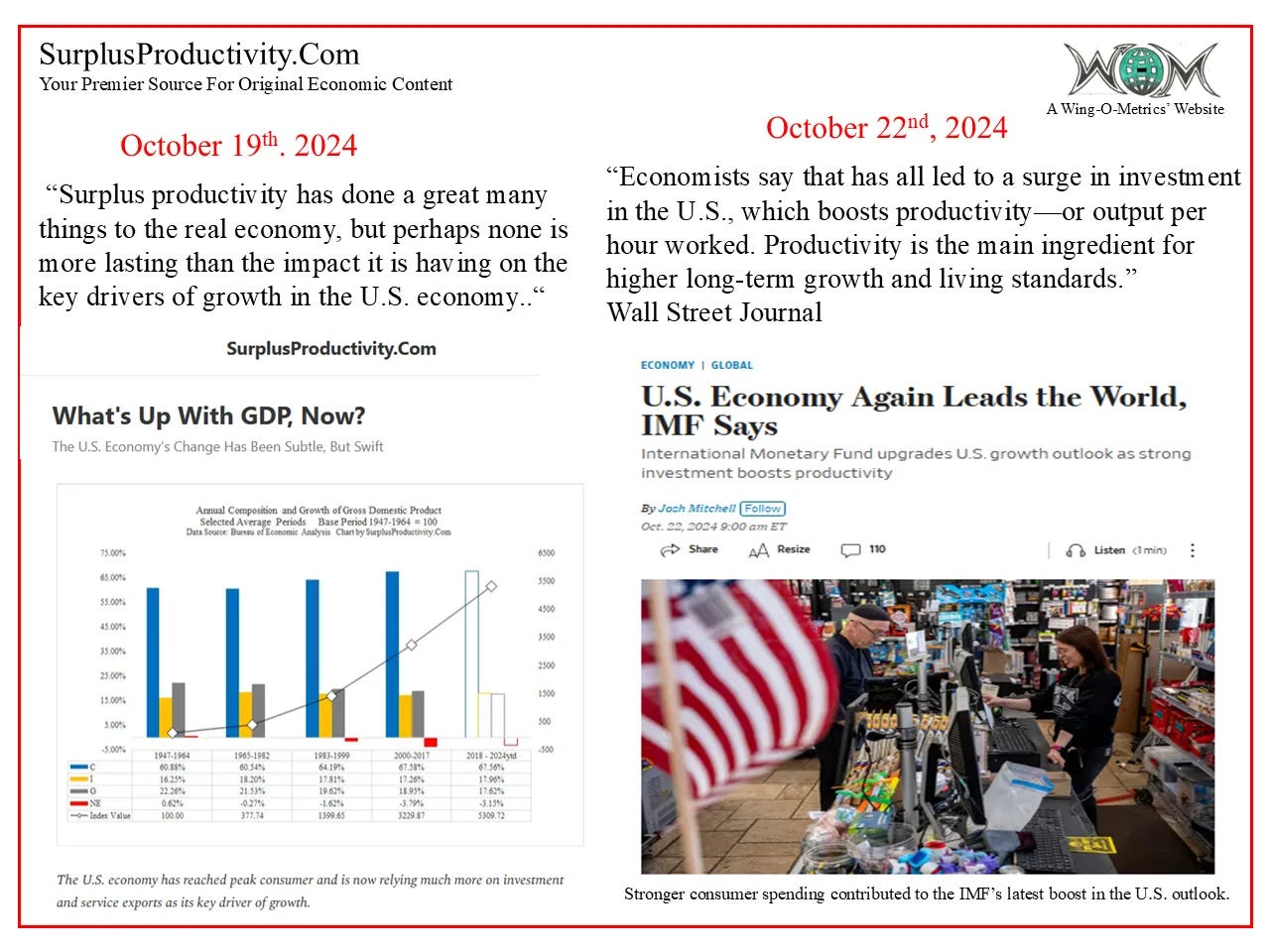

Consumers’ yesterday gives way to (non-res) private fixed investment’s day

Surplus productivity’s lasting impact: The current economic procession

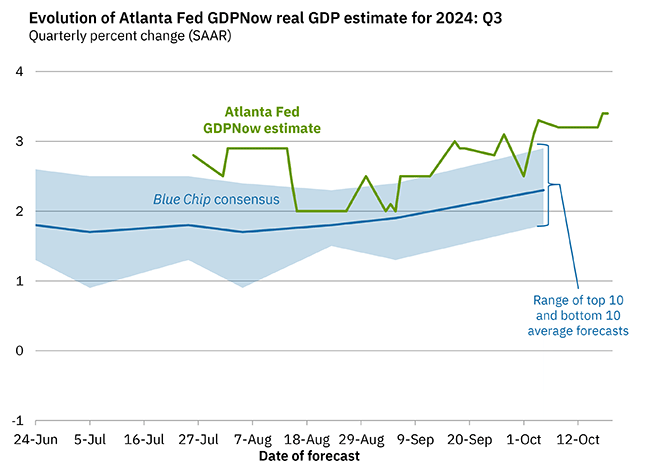

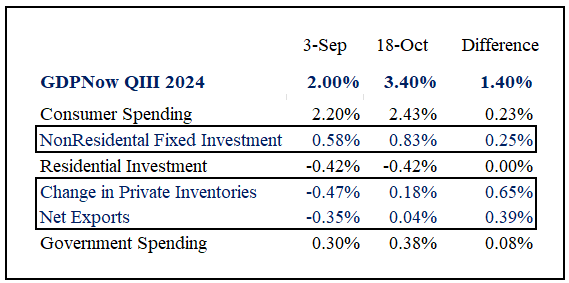

Published just this past week, the Atlanta Federal Reserve’s attempt to track the BEA’s GDP in real-time posted an elevated estimate of 3.4 (SAAR) percent which not only seems gaudy in comparison to where it stood just a month ago, but downright unexpected given forecasts overall. The consistency in the economy, while dumbfounding to some, should not be unexpected, nor should it be confused for some sort of noble characteristic; say resiliency for instance. Rather, the economy is performing as predicted by a surplus productivity-led widening of the output gap and the economic procession it is engineering. To really see the difference, the data must be broken down into the actual components that are driving growth, not just the growth itself.

GDPNow is producing results for QIII that are way beyond material expectations.

When it comes to Gross Domestic Product or GDP as a measure of the economy’s activity, it is first important to understand that the model is designed to capture final demand. For instance, the work of the farmer who grows the wheat and the miller who processes it into flour and the baker who bakes it into a loaf a bread and the grocer who sells it isn’t captured until the consumer actually purchases it for final consumption. As a result, the GDP calculation is naturally biased towards consumption, and consumer spending will always play an outsized role in the headline data. When it comes to this past month’s transition in GDPNow, however, it is crucial to see how other smaller measured areas of the economy are having a much bigger pull on the direction of growth.

GDPNow’s evolution has more to do with inventories and investment than anything else.

As the table above shows, the change in GDPNow has less to do with the consumer and much more to do with investment and a change in private inventories. In the overall official calculation of GDP, the change in private inventories is included in gross private investment so the actual push higher is to the tune of 0.90 percent overall. At the same time, net exports as proved to have an uncharacteristically

Keep reading with a 7-day free trial

Subscribe to SurplusProductivity.Com to keep reading this post and get 7 days of free access to the full post archives.