As Go Durable Goods Prices, So Too The Fed

A Small Area Of The Economy Is Over Weighting The Fed

July 11th, 2025 - Volume 11 (2025) Missive 106 (Friday)

Durable goods prices are determining Fed Funds

Prices don’t match demand

Liquidity fears fuel 30yr Treasury auction

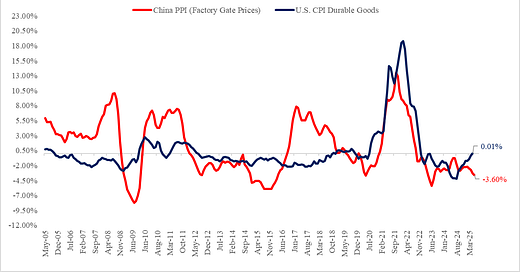

For all the reasons the Fed should be cutting rates, one small obstacle is running very large interference: U.S. durable goods prices. Basically all of the price volatility that the Fed has either complained about or championed, depending upon its direction, can simply be traced back to that of the behavior of durable goods prices. Durable goods are those goods which tend to be infrequent in purchase but also of high dollar value. While not all durable goods are expensive (a hammer is a durable good), some of the more notable are like motor vehicles and appliances certainly are. As such, economists tend to watch any movement in demand, and subsequently prices, with particular attention. This is acutely the situation today as although the entire sector accounts for just a small part of the economy, durable goods prices are having an outweighed influence on monetary policy overall. Some of that is political no doubt as durable goods prices are highly transparent so it gives the Fed a great hook on to which rest their hat. However, most of it boils down to napkin logic as it is assumed that prices do indeed reflect demand. Unfortunately, that relationship is no longer as solid as it once was leaving the Fed on increasingly shaky ground.

U.S. consumer durable goods prices are disconnected from demand.

The breakdown between actual demand to that of durable goods price has yet to be fully appreciated by policymakers at the Federal Reserve leaving them precariously close to losing a total grip on the economy’s needs. Many measures are indicating that final durable goods prices domestically are running afoul to the actual underpinnings of demand for the products themselves. China, for example, continues to record

Keep reading with a 7-day free trial

Subscribe to SurplusProductivity.Com to keep reading this post and get 7 days of free access to the full post archives.