November 30th, 2024 - Volume 10 (2024), Missive 259 (Saturday)

Upward push on 10yr note yield faltering fast and now going how low?

Flatter figuratively forever

Inflation expectations expect lower inflation

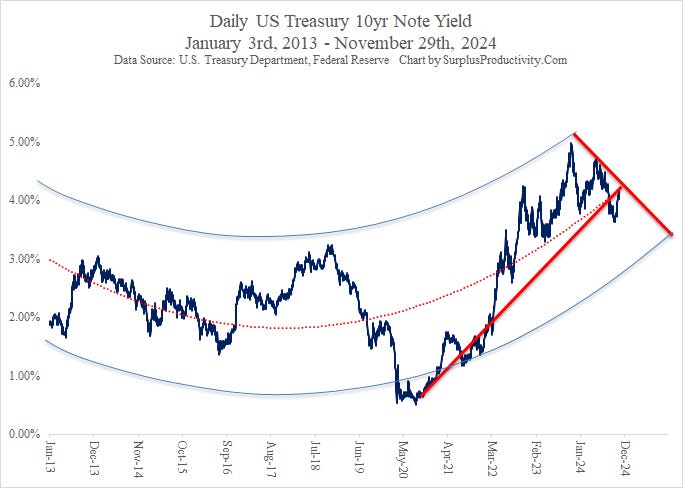

A lot has been unfortunately written about the yield on the U.S. Treasury Note rising since the Federal Reserve began cutting rates back in September. This, however, has been a disingenuous narrative - as most headline baiting story lines are - as the actual yield on the aforementioned Treasury Note has actually fallen 77 basis points from its peak of 4.95 percent back on October 25th of 2023 to yesterday’s close of 4.18 percent. More so, it is apparent that taking a longer look at its performance, the yield on the 10yr UST has been facing some very significant resistance over the past year. This past week alone has been especially telling as despite the holiday-shortened trading days, the yield has collapsed 23 basis points alone. While short-term narratives play out well in the short-term, the longer-term economic fundamentals driving the change are much more important, no matter the fact it takes more than a byline to explain them. In this case, the headlines aren’t the only thing falling flat these days.

The long-term direction of the 10yr yield is beholden to that of surplus productivity.

While its fun to peg the daily or weekly change in yields of marketable Treasury securities across the curve, their ultimate destiny belongs squarely to that of surplus productivity and its impact on the shape of the output gap. That’s why the yield on the benchmark 10yr, for instance, will eventually fall all the way down

Keep reading with a 7-day free trial

Subscribe to SurplusProductivity.Com to keep reading this post and get 7 days of free access to the full post archives.