GD(IP)P

The First Look Is Actually The Second

December 23rd, 2025 - Volume 11 (2025) Missive 150 (Tuesday)

GDP gets a big boost from service consumption via disinflation

Investment growing faster than government

Labor compensation near all-time low

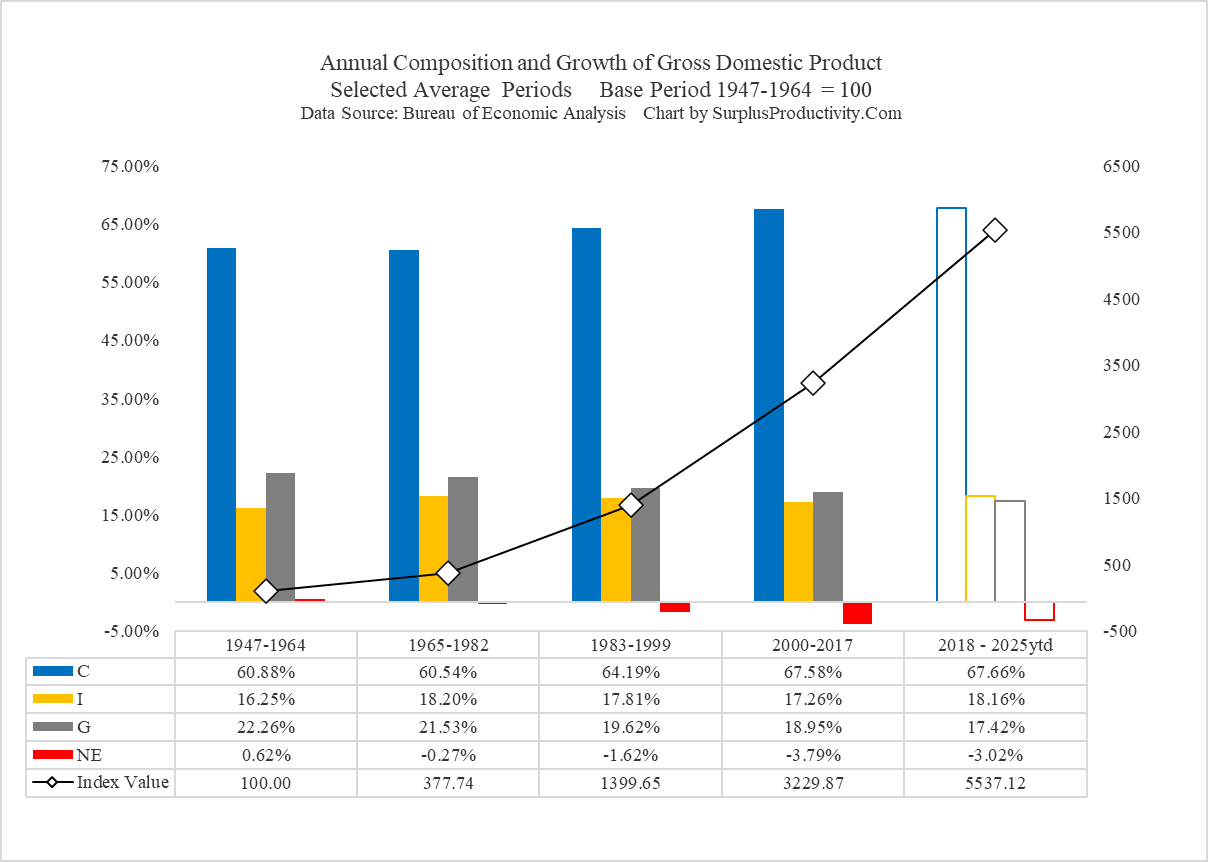

Economists have been waiting a while for the latest numbers on the economy’s growth in domestic product and boy did this morning’s release not disappoint. Coming in at a seasonally adjusted annualized return of 4.3 percent for the quarter, today’s numbers are the fastest pace of expansion since the 4.7 percent posted two years ago. Consumption was again the key driver to the overall GDP statistic last quarter as expenditures on goods and services expanded by 3.5 percent in QIII of 2025 compared to 2.5 and 0.6 percent in the previous two quarters. That being said, it was service consumption that really set the stage for consumer expenditures last quarter, expanding 3.7 percent SAAR; its fastest quarterly pace of expansion since the 4.2 percent increase in QII of 2022. To be fair, consumption will always be the key driver of growth due to the very simple fact that GDP is a measure of final demand and in a market-based economy most final demand comes in the form of consumption. However, it is just as important to signal out the other components to economic growth and in this case, specifically that of investment which has been uncharacteristically outpacing the government contribution to GDP for the last 7 years.

The consumer once again drove GDP (as expected) but the real story is the investment variable.

Economically ironic, perhaps, to highlight the contribution that gross private investment has had on GDP since 2018 on a day when the quarterly data reports that it actually took away 0.3 percent from the headline number. In fact, it is the second such quarter in a row that that “I” in C+I+G+NE has reduced GDP versus adding to it. Despite this tariff related near-term weakness, it is extremely important to point out that since 2018, investment has been the second largest area of growth in the economy surpassing that of the government’s contribution. And while housing (both residential