June 15th, 2023

Policymakers at the Federal Reserve decided not to decide yesterday by keeping its target overnight lending rate at its current range-bound rate of 5.00 to 5.25 percent. Citing the need for additional data as well as normal lags in policy administration, the FOMC’s nonaction wasn’t all that of a surprise. In fact, many economists and analysts had walked a tight forecasting line between a rate hike and a rate pause for weeks now; either of which result probably wouldn’t have sparked any great calamity at least here in the present. The incoming data is nothing in particular and will likely cover all the information made public within the next six weeks (seeing how the next scheduled FOMC meeting isn’t until July 25th). This would include another jobs report, a more detailed GDP report, CPI, PCE, and all the other monthly releases. One number in particular that stands out to us, though, is the capacity utilization rate that always accompanies the industrial production report; a report released just hours ago.

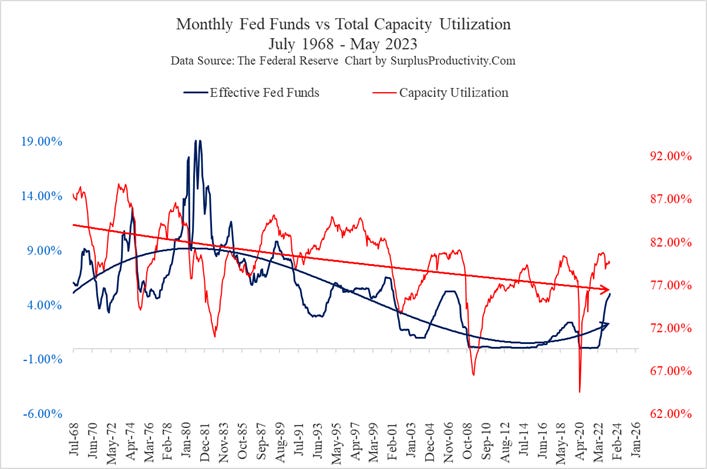

The correlation between Cap U and Fed Funds is strong for a reason.

Although it tends to be overlooked somewhat, the correlation between rates of capacity utilization in the nation’s manufacturing sector to that of Fed funds is indeed very strong. Keep in mind that the industrial production report is a Federal Reserve produced report so during times of greater policy uncertainty, the Fed is likely to feast more on its own cooking. Besides that point, the correlation between the two rates is grounded in solid economic logic. More specifically, rates of capacity utilization still tend to be a relatively accurate gauge of the economy’s output gap. Given the fact that manufacturing businesses work on very sharp margins, they have an economic ear to the ground, reacting much quicker to any perceived strengths or weaknesses to the business cycle. As such, they will more readily ramp-up or slowdown production than say a service provider. Because of this, fluctuations in how much capacity

Keep reading with a 7-day free trial

Subscribe to SurplusProductivity.Com to keep reading this post and get 7 days of free access to the full post archives.