The Yield On The UST 30yr Has A Lot Of Room To Run Lower

The Fed Will Find It Hard To Cut, But The Market Won't

September 12th, 2025 - Volume 11 (2025) Missive 123 (Friday)

Demand for the 30yr is being impedded by an impeded Fed

Yield curves point to economic procession

30yr will eventually yield less than 1.0 percent

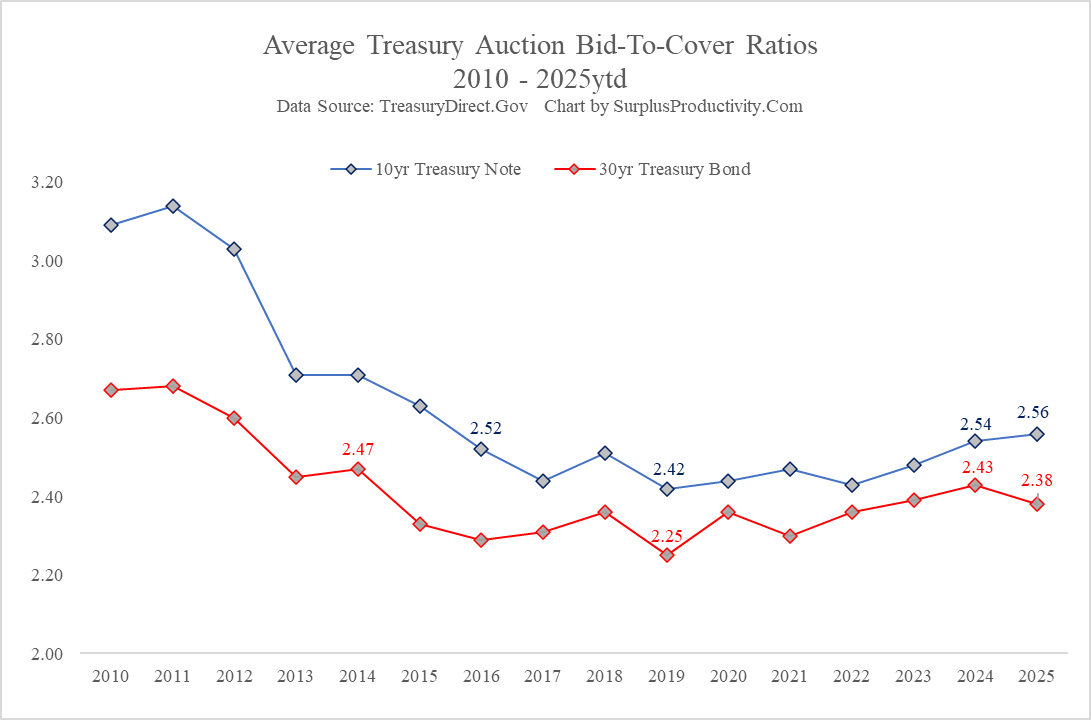

The yield on the U.S. 30yr Treasury bond has a lot of room to run lower and a lot of time to get there. The results of yesterday’s $22.0 billion auction speak largely to the obstacles standing in its way. For example, whereas the previous day’s 10yr auction posted stellar results ( a bid-to-cover of 2.65) the 30yr’s rather meager performance (a bid-to-cover of 2.38) seemed downright paltry by comparison. While the 30yr does tend to come in under the 10yr when it comes to performance, the lag tends to be stable. That is to say, although the bid-to-cover is typically lower, that difference doesn’t deviate in trend; until this year any ways. If the year was to end right now, in fact, demand for the 10yr at auction would be an improvement over last year while demand for the 30yr would actually have fallen. This is a rather unusual development which strikes at the heart of the economic matter: the Fed should be cutting rates but won’t have the luxury of the data to support it. That means that the Fed will be dragging its feet when it comes to getting monetary policy where it actually belongs which all but guarantees continues trepidation for the 30yr bond yield until it finally gets to where it needs to be.

Demand for the 30yr at the auction is worse (so far) this year than it was last year which is at odds to that of the 10yr.

Eventually, the yield on the 30yr will tumble much lower than current levels, even to the point of setting historical lows below 1.0 percent. However, that is unlikely to happen soon. While the surplus productivity-led widening of the output gap will make that a reality, the simple fact of the matter is that the Fed will continue to embark on a less than efficient model in lowering rates. Much too dependent on headline economic data, yesterday’s CPI is a stark reminder of

Keep reading with a 7-day free trial

Subscribe to SurplusProductivity.Com to keep reading this post and get 7 days of free access to the full post archives.